how to lower property taxes in texas

House Bill 3 was an 116 billion school finance bill that included 51 billion to lower school district taxes 65 billion in new. Apply for Property Tax Relief.

Texas Lawmakers Call For A Swap Higher Sales Taxes Lower Property Taxes

Property tax exemptions are one of the most meaningful and simple ways to reduce property taxes.

. On a whim today I looked up a massive rural property on 400. Assessing the Value of Housing How Is Property Tax Calculated. The Texas legislature has provided numerous property tax exemptions.

Texas offers a variety of partial or total sometimes referred to as absolute exemptions from appraised property values used to determine local property taxes. Why are property taxes in Texas so high. Check assessment notice for inaccuracies.

Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help. The property tax on your house is evaluated. Prepare Information for Hearing.

For individuals 65 and older in Texas there is no way to freeze all property taxes. If you think that your property tax is higher than those of others with similar homes in the area you stand a good chance of having your property tax lowered. Property tax relief that doesnt lower your tax bill.

However there is what is called a tax ceiling freeze. CAD taxable values are as follows. Texas lawmakers tried to lower property tax bills during their 2019 session and a new report says they put a dent in.

Abbott points to rising property valuations in Texas spurred by the states booming real estate market as the reason property taxes have been on the rise deflecting blame from his office. Fight Hard To Have Your Tax Value Reduced. To protest your appraisal districts appraisal of your property submit a completed Notice of Protest Form Form 50-132 and.

Property taxes are typically higher in states that have no income tax. Most taxing districts evaluate property values every two years and in down markets rarely. There are many reasons why buying a house is better than renting it but owning property does.

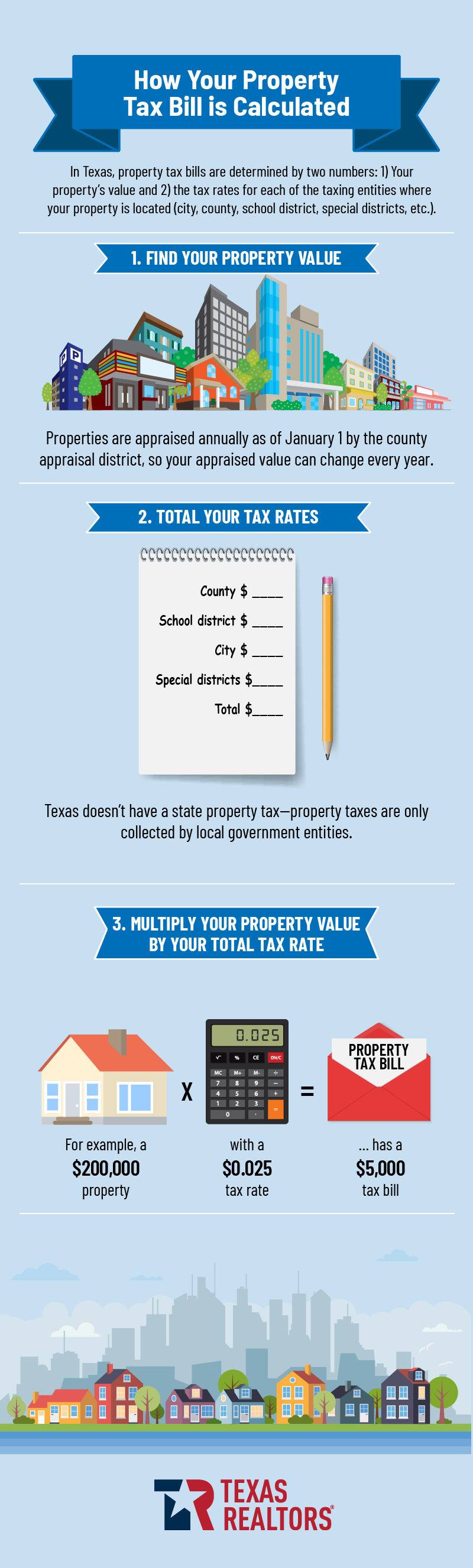

How to Lower Your Texas Property Tax the assessed value of the property a property tax exemption may reduce the taxable value of the property the tax rate that is applied to the. Back in July I laid out for you a new setup in which you go to a state government website and tap out an email to your elected officials about the new. If your home is valued at 75000 for example but you have a 10000.

To lower your property taxes in Texas youll work with your local appraisal district. If not file the exemptions with your county to lower your property taxes. 2 days ago1235 PM on Oct 6 2022 CDT.

There are property tax relief options available to you though they arent automatically granted. A thorough review of the Notice of Appraised Value aka. Over the life of the loan youll end up paying 164000 in interest.

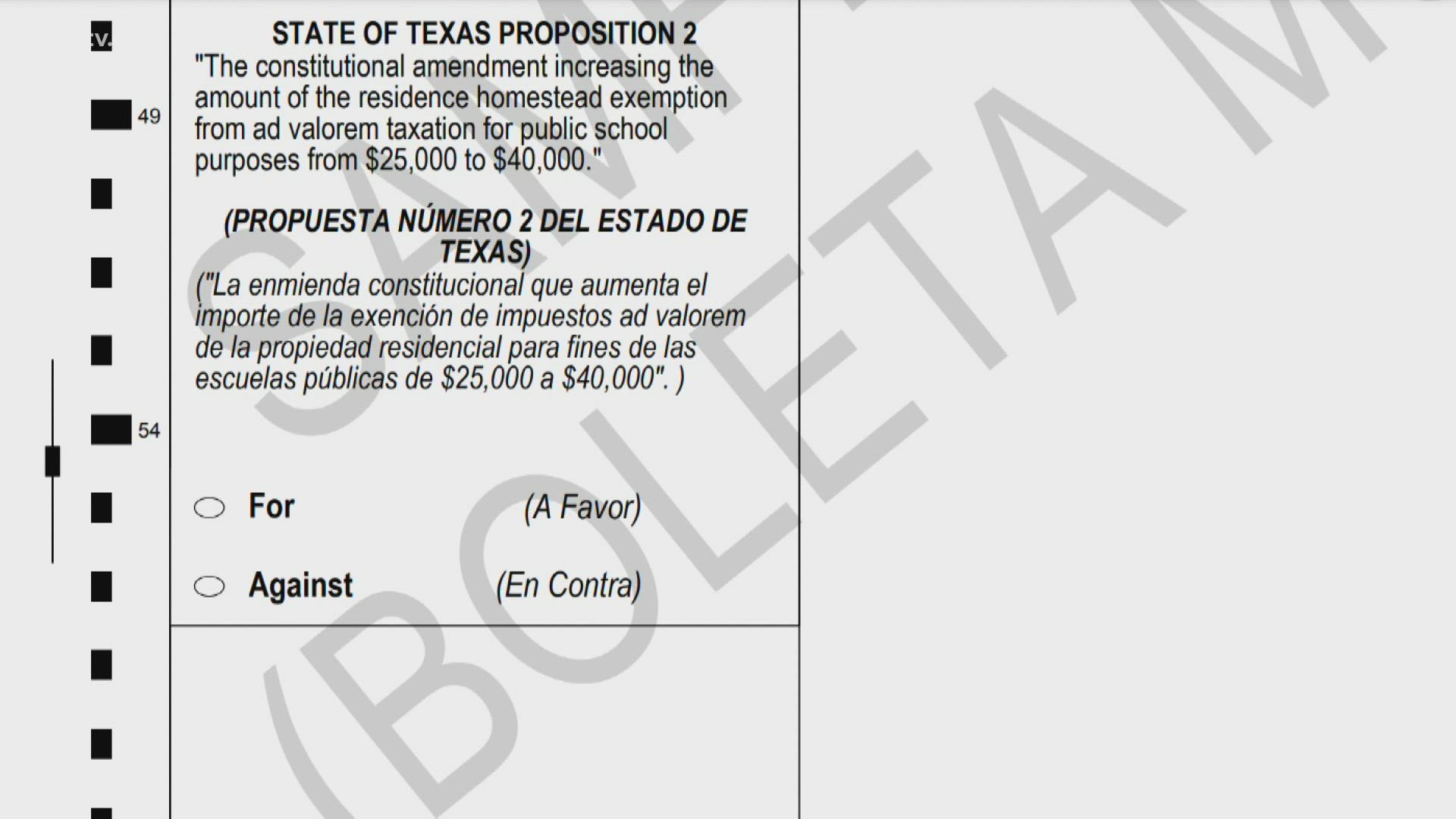

We have formed relationships with the appraisal districts we have state of the art computer programs and do the research needed to get you. This proposition increases the homestead exemption amount from 25000 to 40000. In order to come up with your tax bill your tax office multiplies the tax rate by.

Multiply that number by your districts tax rate and you have your property taxes. Tax cards are public. For example lets say you have a 200000 mortgage with an interest rate of 45.

Only one county voted against both Texas propositions in May 7 election. File a Notice of Protest. Your local tax collectors office sends you your property tax bill which is based on this assessment.

There are discounts in property taxes in Texas available for. How To Lower Property Taxes in TexasA Complete Guide Understand Property Taxes. But if you refinanced to a lower rate of 35.

Use the equal and uniform method to justify that your taxable value. One of the ways to lower your property taxes in Texas is to qualify for any one of the different exemptions available. How do I freeze my property taxes at age 65 in Texas.

Propositions That Could Lower Your Property Taxes Kcentv Com

Property Tax Education Campaign Texas Realtors

How To Protest Your Property Taxes In Texas Home Tax Solutions

New Property Tax Book Available Poconnor Com

Texas Voters Will Decide Whether To Lower Some Property Tax Bills

How To Improve Texas Property Tax System Update Every Texan

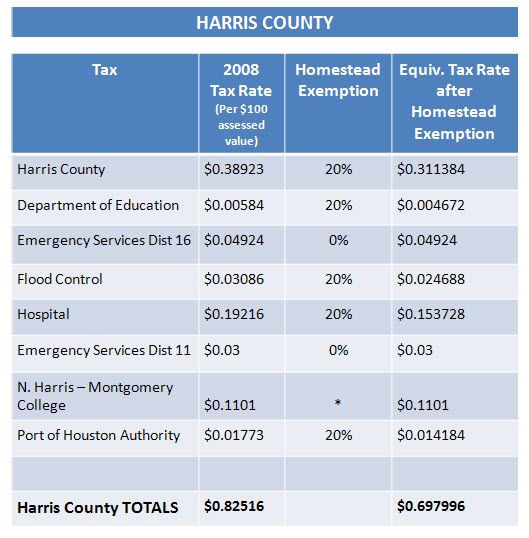

Who Has Lower Real Estate Taxes Montgomery County Or Harris County Discover Spring Texas

How To Lower Your Property Taxes In Texas

How To Lower Your Property Taxes In Texas Even If You Pay The Mud Tax

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Texas Lawmakers Promised To Increase School Funding And Lower Property Taxes Here S What They Did Kut Radio Austin S Npr Station

Texas Leaders Propose Raising State Sales Tax To Lower Property Tax Rates Kvue Com

Property Taxes Down Fees Up In Proposed Austin 2023 Budget

How To Protest Your Houston Home S Appraisal Value And Pay Lower Property Taxes

Property Taxes In Texas How To Protest Your 2021 Appraisal Wfaa Com

City Of Lubbock Proposes Lower Property Tax Rate As Building Permits Top 1 7 Billion